Coping with Rising Prices

In a world where the cost of living seems to climb every mountain and sail across every sea, finding innovative ways to navigate the steep slopes of inflation has become more crucial than ever. It’s like being an explorer in an ever-changing landscape, where the tools of yesterday may not suffice for the challenges of today. Amidst this backdrop, the journey towards financial resilience involves more than just traditional strategies; it invites us to look at our financial habits through a new lens, making the most of technological aids like the GOOD (Get Out of Debt) App, a beacon for those seeking to navigate the murky waters of financial management.

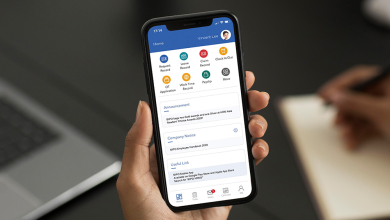

Embracing Technology: The GOOD App Beacon

In the age of digital advancement, the GOOD App stands as a lighthouse for those battered by the waves of rising prices. This innovative tool is not just about getting out of debt; it’s a compass for managing your finances more effectively. By integrating budget tracking, debt management, and savings strategies, the GOOD App empowers individuals to take control of their financial voyage, offering a clear path through the fog of economic uncertainty.

Navigating Through Bulk Purchases and Sales

Imagine yourself as a trader of old, embarking on expeditions to stock up on goods that will last through long voyages. Buying in bulk and timing your purchases to coincide with sales is akin to this ancient practice. It’s about making the most of your resources, securing provisions when they are most abundant and least costly. This strategy not only ensures that you have enough supplies to weather any storm but also allows you to save significantly, turning the tide in your favor in the battle against rising prices.

Charting a Course with Coupons and Comparison Shopping

The art of using coupons and comparison shopping can be likened to navigating by the stars, guiding you towards the best deals and savings. In this digital era, this means leveraging online platforms and apps to compare prices across different retailers, ensuring that you’re always setting sail towards the best value. Coupons, on the other hand, are like finding hidden treasures along your journey, offering discounts and deals that reduce the cost of your voyage.

Steering Away from the Rocks of Credit Card Debt

Credit card debt is the siren call that can lead many a ship astray, enticing with the promise of instant gratification but ultimately leading to a perilous journey through stormy seas. Eliminating this debt is akin to charting a safer course, one that avoids the whirlpools and rocky shores that can sink your financial ship. By prioritizing debt repayment, you’re not just lightening your load but also improving your vessel’s speed and agility, enabling you to navigate through economic challenges with greater ease.

The Wind in Your Sails: Budgeting and Expense Tracking

To truly harness the wind and sail smoothly through turbulent economic waters, effective budgeting and expense tracking are essential. This process is like mapping the currents and winds before setting sail, ensuring that you can make the most of favorable conditions and avoid those that could hinder your journey. By understanding where your resources are going and identifying areas where you can cut back, you’re better equipped to adjust your sails and keep your financial ship on course.

Anchoring in the Safe Harbor of Emergency Savings

In every explorer’s journey, having a safe harbor to retreat to in times of storm is crucial. Building an emergency savings fund serves this very purpose in the realm of personal finance. It’s your financial safe harbor, providing a buffer against unexpected expenses or economic downturns. Aim to save at least three to six months’ worth of living expenses, ensuring that you can weather any storm without taking on additional debt.

The Voyage Ahead: Adaptation and Resilience

As we chart our course through the ever-changing seas of the economy, the key to coping with rising prices lies in our ability to adapt and remain resilient. By embracing both time-honored strategies and modern technological aids like the GOOD App, we can navigate these challenges more effectively, ensuring that our financial journey is both prosperous and fulfilling.

The journey through rising prices and economic uncertainty may be daunting, but with the right strategies and tools at our disposal, we can navigate these turbulent waters with confidence. Like seasoned explorers, we must be prepared to adapt, using every resource available to us—from bulk buying and savvy shopping to technological aids like the GOOD App—to chart a course toward financial stability and success.